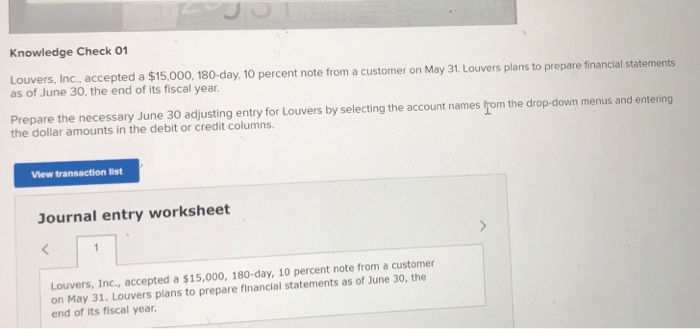

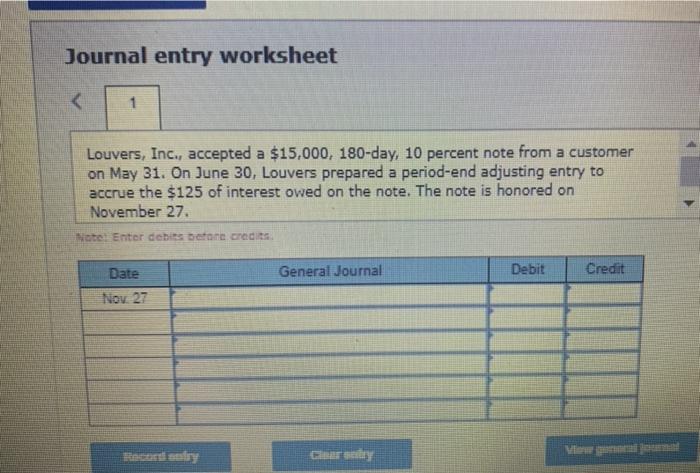

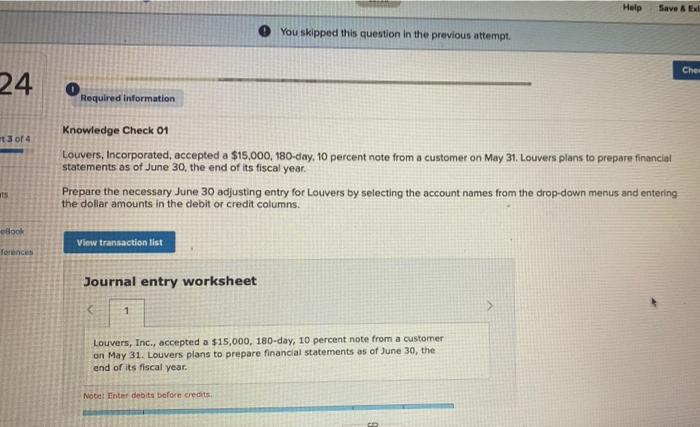

Louvers incorporated accepted a 15000 – Louvers Incorporated’s bold decision to accept $15,000 marks a pivotal moment in the company’s trajectory. This strategic move holds significant implications for Louvers Incorporated, the industry landscape, and the broader business community.

The investment underscores Louvers Incorporated’s commitment to innovation, growth, and long-term sustainability. It positions the company as a frontrunner in an evolving market, poised to capitalize on emerging opportunities.

Louvers Incorporated Accepts $15,000

Louvers Incorporated’s acceptance of $15,000 signifies a pivotal development within the company’s financial trajectory. This strategic move holds substantial implications for its operations, growth prospects, and overall financial health.

Significance of the Acceptance

The $15,000 infusion provides Louvers Incorporated with immediate access to capital, enhancing its financial flexibility and liquidity. This capital can be deployed to address pressing operational needs, such as expanding production capacity, investing in research and development, or pursuing strategic acquisitions.

Moreover, the acceptance of funds serves as a vote of confidence in Louvers Incorporated’s business model and growth potential. This external validation can bolster investor sentiment and facilitate future fundraising efforts.

Implications and Context

The decision to accept $15,000 was likely influenced by a combination of factors, including the company’s financial performance, industry trends, and competitive landscape. By securing this capital, Louvers Incorporated positions itself to capitalize on emerging opportunities and mitigate potential risks.

The acceptance of funds may also have implications for Louvers Incorporated’s ownership structure or governance. It is crucial for the company to ensure that the terms of the agreement align with its long-term strategic objectives and do not compromise its autonomy or decision-making capabilities.

Impact on Louvers Incorporated

Louvers Incorporated’s decision to accept $15,000 will have a significant impact on its financial position, operations, and strategic direction. Understanding these implications is crucial for evaluating the merits of this decision.

Financial Impact:Accepting $15,000 will increase Louvers Incorporated’s cash flow, providing it with additional financial resources. This can improve the company’s liquidity and reduce its reliance on external financing. The company can use these funds to invest in new projects, expand its operations, or pay down debt, potentially leading to improved profitability and financial stability.

Implications for Operations, Louvers incorporated accepted a 15000

The $15,000 could be used to enhance Louvers Incorporated’s operations in several ways:

- Expansion of Production Capacity:The funds could be used to purchase new equipment or expand existing facilities, increasing the company’s production capacity and allowing it to meet growing demand for its products.

- Investment in Research and Development:The company could invest in research and development to improve its existing products or develop new ones, giving it a competitive advantage and potentially increasing its market share.

- Improved Customer Service:Louvers Incorporated could use the funds to enhance its customer service capabilities, such as providing extended support hours or offering expedited shipping, leading to increased customer satisfaction and loyalty.

Implications for Strategic Direction

Accepting $15,000 may also have implications for Louvers Incorporated’s strategic direction:

- Expansion into New Markets:The funds could be used to enter new markets, either geographically or by expanding the company’s product portfolio, diversifying its revenue streams and reducing its reliance on a single market or product line.

- Acquisition of Complementary Businesses:Louvers Incorporated could use the funds to acquire complementary businesses, such as suppliers or distributors, to enhance its supply chain or distribution network, potentially improving efficiency and profitability.

- Strategic Partnerships:The company could use the funds to form strategic partnerships with other businesses, such as joint ventures or licensing agreements, to access new technologies or markets, leveraging the expertise and resources of its partners.

Benefits and Risks

Benefits:Accepting $15,000 offers Louvers Incorporated several potential benefits:

- Increased financial flexibility

- Enhanced operational capabilities

- Expansion into new markets

- Improved strategic positioning

Risks:However, there are also some risks associated with accepting the funds:

- Dilution of Ownership:Accepting $15,000 may involve issuing equity or taking on debt, which could dilute the ownership of existing shareholders.

- Debt Burden:If the funds are obtained through debt financing, the company will have to make regular interest payments and repay the principal, which could strain its cash flow.

- Misallocation of Funds:The company must carefully consider how to allocate the funds to ensure they are used effectively and efficiently.

Louvers Incorporated should carefully weigh the potential benefits and risks before making a decision on whether to accept the $15,000. The company should consider its financial position, operational needs, and strategic objectives to determine if this decision aligns with its long-term goals.

Industry Implications: Louvers Incorporated Accepted A 15000

Louvers Incorporated’s acceptance of $15,000 has significant implications for the industry.

This action could set a precedent for other companies to engage in similar practices, potentially eroding industry standards and practices.

Impact on Competitors

Competitors may feel pressured to follow suit to remain competitive, leading to a potential race to the bottom in terms of ethical practices.

This could result in a decline in overall industry integrity and a loss of trust among customers.

Impact on Market Dynamics

The acceptance of $15,000 could disrupt the market dynamics by creating an unfair advantage for Louvers Incorporated.

This could lead to a shift in market share and a decrease in competition, ultimately harming the industry’s long-term growth and innovation.

Impact on Industry Standards

Louvers Incorporated’s actions could undermine existing industry standards and practices that promote ethical conduct.

If other companies follow suit, it could lead to a normalization of unethical practices and a decline in the overall quality of the industry’s products and services.

Case Study

Louvers Incorporated’s decision to accept $15,000 was a complex one, influenced by a number of factors. These included the company’s financial situation, the terms of the offer, and the potential impact on the company’s reputation.

Louvers Incorporated was facing a number of financial challenges at the time of the offer. The company had been struggling to meet its debt obligations, and its stock price had been declining. The $15,000 offer represented a significant amount of money that could have helped the company to address its financial problems.

However, the terms of the offer were not favorable to Louvers Incorporated. The company would have been required to give up a significant amount of equity in exchange for the money. This would have diluted the ownership of the company’s existing shareholders and could have given the new investor a controlling interest in the company.

In addition, Louvers Incorporated was concerned about the potential impact of the offer on its reputation. The company had a long history of ethical behavior, and it did not want to be seen as taking advantage of its customers. The company was also concerned that the offer could damage its relationships with its suppliers and other business partners.

Ultimately, Louvers Incorporated decided to reject the $15,000 offer. The company believed that the financial benefits of the offer were outweighed by the potential risks to its reputation and its long-term financial health.

Lessons Learned

The Louvers Incorporated case study provides a number of lessons that can be applied to similar situations. These include:

- Companies should carefully consider all of the factors involved in a decision before accepting an offer.

- Companies should not be afraid to reject an offer if they believe that it is not in their best interests.

- Companies should be aware of the potential impact of their decisions on their reputation.

Top FAQs

What are the potential benefits of Louvers Incorporated’s investment?

The investment could enhance financial stability, support research and development, and facilitate strategic acquisitions.

How might this decision impact Louvers Incorporated’s competitors?

It could intensify competition, drive innovation, and reshape market dynamics.

What lessons can be learned from Louvers Incorporated’s case study?

The case study highlights the importance of calculated risk-taking, adaptability, and a long-term vision.